Netflix hand-delivered 256 pages (pdf) to the US government this week arguing that Comcast shouldn’t be allowed to acquire Time Warner Cable. “The proposed merger puts at risk the end-to-end principle that has characterized the internet and been a key driver in the creation of the most important communication platform in history,” Netflix’s lawyers wrote.

The streaming video company’s filing provides much more detail about its negotiations with Comcast earlier this year that led it to pay for more direct access to Comcast’s internet customers. “In Netflix’s experience, there are four ISPs that have the market power to engage in degradation strategies to harm OVDs,” Netflix wrote, referring to internet service providers (ISPs) intentionally slowing down traffic from online video distributors (OVDs). “Two of those four propose to merge in this transaction.”

Comcast contends it’s only fair that Netflix pay for putting so much data on its networks. “The only company who decides how Netflix traffic is delivered to us is Netflix,” Sena Fitzmaurice, a Comcast spokeswoman, wrote in an email. “They choose the path the traffic takes to us. They can choose to avoid congestion or inflict it.”

Below is the section of Netflix’s filing on its dealings with Comcast.

* * *

Netflix’s Shift to Transit Providers and Its Deployment of Open Connect.

The threat of new access fees being passed through to Netflix were making third-party CDNs [content delivery networks] a less certain option for Netflix and in early 2012, Netflix began to transition its traffic off of CDNs and onto transit providers with settlement-free routes into Comcast’s network. Netflix also was preparing to launch its own CDN, Open Connect, which would bear most of the burden of delivering traffic to terminating access networks’ subscribers. Netflix continues to invest significantly in Open Connect, an effort that has more than 100 million dollars in research, development, and deployment costs.

A few months before Netflix launched Open Connect, it also purchased transit from Cogent, which had a settlement-free peering arrangement with Comcast. Netflix’s experience with Cogent resembled its experience with Level 3. Shortly after Cogent began delivering Netflix traffic requested by Comcast subscribers, Cogent’s routes into Comcast’s network started to congest. According to Cogent’s CEO, “[f]or most of Cogent’s history with Comcast…[as] Comcast’s subscribers demanded more content from Cogent’s customers, Comcast would add capacity to the interconnection points with Cogent to handle that increased traffic.” After Cogent began carrying Netflix traffic, however, “Comcast refused to continue to augment capacity at our interconnection points as it had done for years prior.”

Congestion into Comcast’s Network Reaches a Critical Threshold

Netflix attempted to address congested routes into Comcast by purchasing all available transit capacity from transit providers that did not pay access fees to Comcast—which involved agreements with Cogent, Level 3, NTT, TeliaSonera, Tata, and X0 Communications. Although all six of those providers sold transit to the entire Internet, only three of them—Cogent, Level 3, and Tata—had direct connections to Comcast’s network.

In 2013, congestion on Cogent’s and Level 3’s routes into Comcast’s network steadily increased, reaching a level where it began to affect the performance of Netflix streaming for Comcast’s subscribers. [Redacted section.] When Netflix approached Comcast regarding the lack of uncongested settlement-free routes available to its network, Comcast suggested that Netflix return to using CDNs, which Comcast could charge access fees that would then be passed on to Netflix, or use a Tier 1 network like which charged its own access fees. Comcast made clear that Netflix would have to pay Comcast an access fee if Netflix wanted to directly connect with Comcast or use third-party CDNs. In essence, Comcast sought to meter Netflix traffic requested by Comcast’s broadband subscribers.

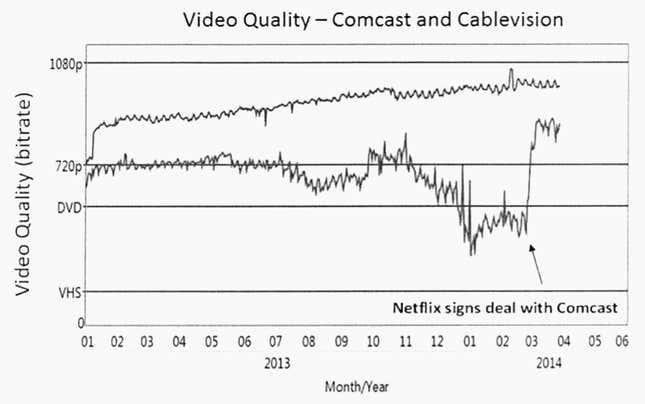

Congested interconnection points affected Netflix traffic bound for Comcast subscribers throughout 2013. In December 2013 and January 2014, however, congestion on routes into Comcast’s network reached a critical threshold and Comcast’s and Netflix’s mutual customers were significantly harmed. Comcast subscribers went from viewing Netflix content at 720p on average HD quality) to viewing content at nearly VHS quality. For many subscribers, the bitrate was so poor that Netflix’s streaming video service became unusable.

The degraded viewing quality for Comcast subscribers also resulted in a sharp increase in calls to Netflix customer support. Those calls made clear that Comcast was well aware of the degradation of Netflix traffic and was directing its subscribers to contact Netflix.

The fact that the height of the congestion occurred in December and January is significant. December is one of Netflix’s busiest times because members spend more time home over the holidays and therefore request more streaming video from Netflix and other OVDs. It became clear that Comcast would continue to allow congestion across its network to negatively affect its subscribers’ online video streaming experience. Netflix began to view the degradation [redacted section].

Netflix Agrees to Pay Comcast an Access Fee for Direct Interconnection.

Despite purchasing transit on all available routes into Comcast’s network that did not require direct or indirect payment of an access fee to Comcast, the viewing quality of Netflix’s service reached near-VHS quality levels. Faced with such severe degradation of its streaming video service, Netflix began to negotiate for paid access to connect with Comcast. Netflix and Comcast eventually reached a paid agreement. Within a week of that agreement, viewing quality for Netflix streaming video on Comcast’s network shot back up to HD-quality levels. The following graph, comparing viewing quality on Comcast’s network with that of Cablevision (an Open Connect partner) demonstrates the rapid, massive improvement:

Figure 5: Video Quality

Comcast was the first large terminating access network to successfully implement a “congest transit pipes” peering strategy to extract direct payment from Netflix, but it is not the only one to do so. Since agreeing to pay Comcast, Netflix also has agreed to pay TWC, AT&T and Verlzon for interconnection. [Redacted section.] Netflix is not the only edge provider to encounter Comcast’s peering strategy. In a 2011 filing with the Commission, Voxel, a hosting company relying on Tata for interconnection with Comcast’s network, noted that “[w]here broadband ISPS typically ensure that links connecting their customers to outside networks are relatively free from congestion, Comcast appears to be taking the opposite approach: maintaining highly-congested links between its network and external ISP.” The letter concludes that Comcast, through its “interconnection relations,” had “deployed an ecosystem in which hosting companies such as Voxel are effectively forced to pay Comcast to serve its broadband subscribers.” In that ecosystem, “it is simply not possible for competing external providers to deliver gaming, or streaming video services to Comcast’s broadband subscribers” without directly or indirectly paying Comcast.